Transform how you sell banking products

Banking CRM to complement your core customer record system. Acquire, engage, onboard customers & cross-sell in one platform

Banking CRM to complement your core customer record system. Acquire, engage, onboard customers & cross-sell in one platform

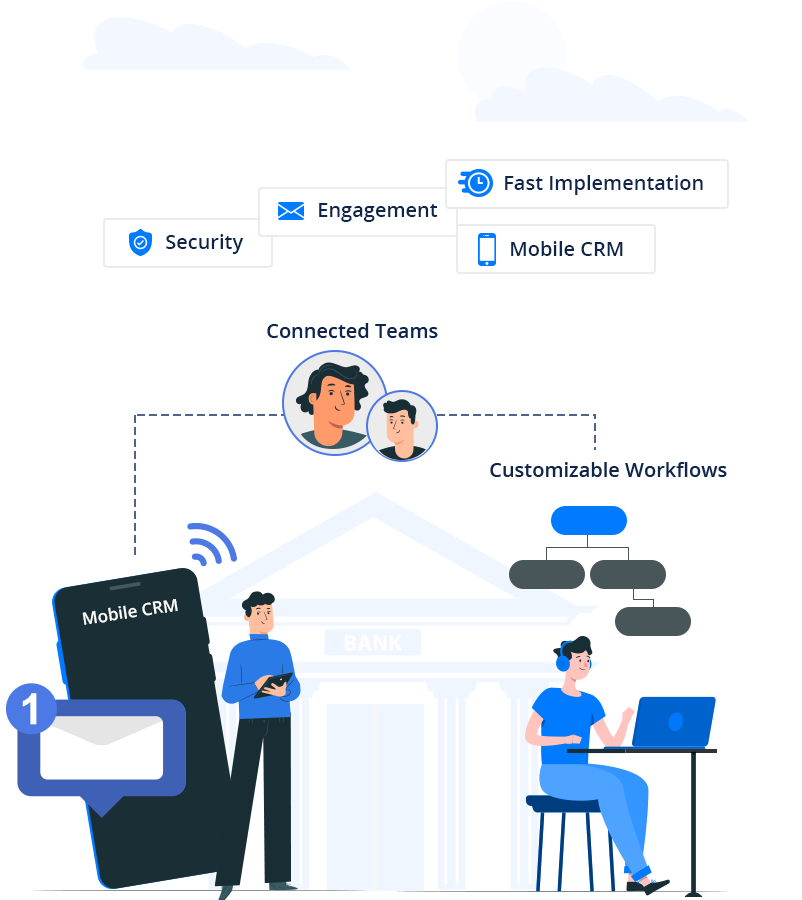

Reduce customer acquisition & ownership costs, and connect all your teams and core systems securely

Customize all your new customer acquisition, engagement, and sales operations workflows.

The security & privacy of your prospects & customers is ensured with strict measures. Read more

While configuring other enterprise banking software can take months, LeadSquared gets you started in days

We are here to enhance your existing processes, not replace them – connects with traditional banking CRMs seamlessly

Drive more prospects to conversion with multi-channel engagement – email, text, WhatsApp, call center, and more

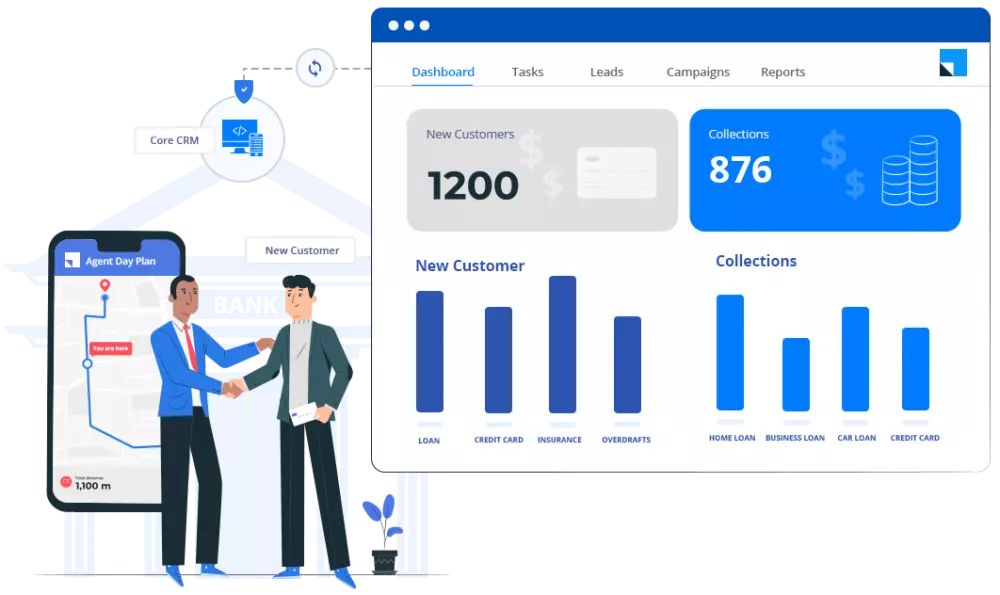

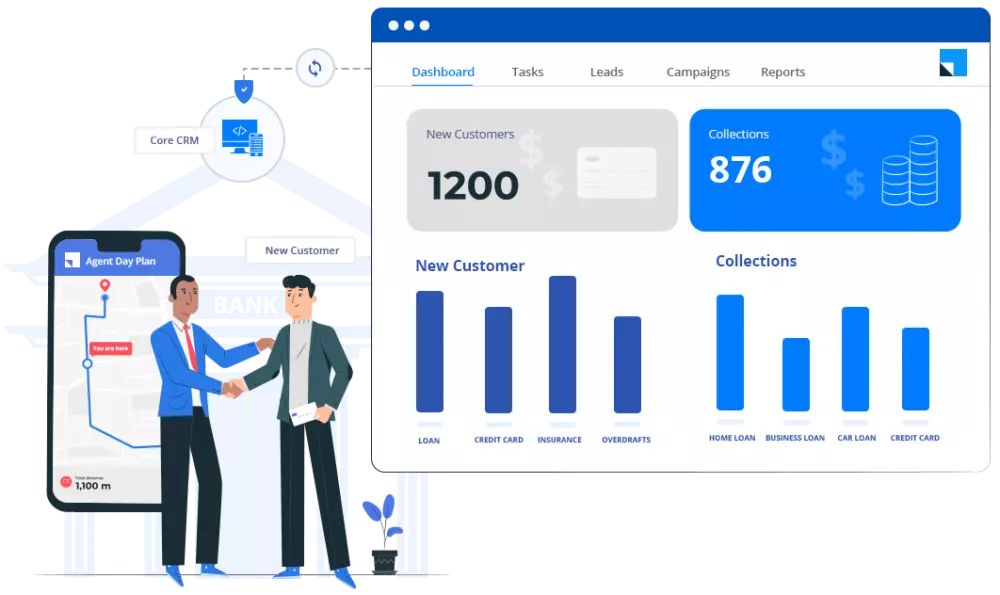

Plan your agents’ day completely, allow them to identify prospects near them, and track everything they do on the field

Use LeadSquared for new customer acquisition, onboarding, collections, cross-selling and more

LeadSquared helps us manage our lending partnerships with banks & NBFCs, and our internal processes across the lending lifecycle (sales, credit, verification & operations) to disburse loans 30% faster than before. Our DSAs are 55% more efficient than before, and all their work is trackable.

Accelerate your Digital Sales + Make your Agents and Relationship Managers more Productive

What is CRM in banking?

CRM in banking refers to managing relationships with customers by understanding their needs and requirements, onboarding new customers, providing them timely support, and retaining them. A customer relationship management software built specifically for banking operations helps manage end-to-end relationships with customers – from the time of inquiry to conversion and beyond.

Do banks use CRM systems?

CRM is a necessary tool for any customer-focused industry. For banks, CRM software is beneficial because it streamlines all the customer-facing aspects of the business – marketing, sales, operations, and customer support. Many leading banks across the globe use CRM to manage their teams, sales, and customer relations.

What is the role of customer relationship management (CRM) in the banking sector?

A CRM solution in banking helps banks and financial services manage customers and better understand their needs to provide the right solutions instantly. CRM software lets banks streamline all their sales channels – digital, call center, relationship managers, and agencies and makes them more efficient.

What are the types of CRM in Banking?

You can find banking CRM that covers all banking-related operations, or you can opt for the CRM designed for the specific sectors, such as:

– Corporate banking CRM

– Commercial CRM or Retail banking CRM

– Lending CRM

– Collections CRM

– Investment banking CRM

What are CRM best practices in the banking industry?

CRM for banks is a great tool to provide personalized customer experiences and manage sales and operations efficiently. To make the most of the CRM solution, use behavioral data to send personalized, triggered marketing campaigns, use predictive analytics to understand customer sentiments and forecast sales, and automate operational tasks to free your resources for sophisticated, relationship-building tasks.

(+1) 732-385-3546 (US)

080-47359453 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)